The Development Council for Buffalo County has announced their opposition to the proposed EPIC Option tax in Nebraska. The Tax Foundation's recent report has strengthened the Council's stance as it revealed significant findings.

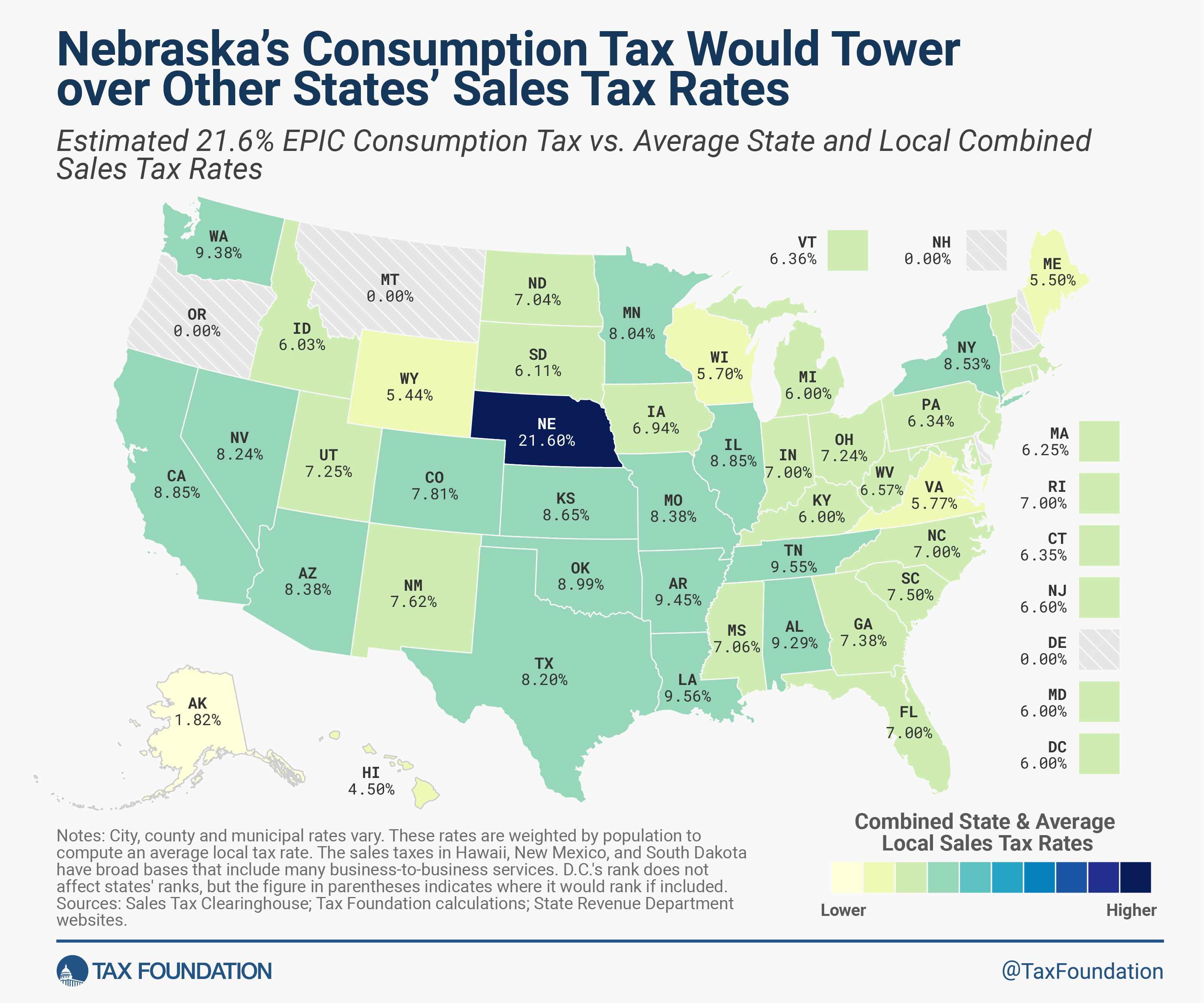

The EPIC Option aims to eliminate income, property, and inheritance taxes and replace them with a statewide consumption tax. However, the Council believes that the proposed 7.5 percent rate is based on flawed calculations and does not accurately reflect the tax base defined in the underlying proposal. According to the Tax Foundation, a consumption tax rate of 21.6 percent or more would be required under the EPIC plan. Moreover, the EPIC Option does not prevent local governments from implementing consumption taxes, which means the total rate could be much higher than advertised.

Additionally, the report predicts that the EPIC Option would likely cause substantial cross-border shopping. This would enable Nebraskans who live near a border with a state with a lower sales tax to take advantage of the lower rates. In the case of EPIC, this includes every bordering state. This could leave taxpayers in the interior of the state to bear the burden of the newly established consumption tax. Furthermore, the anticipated economic benefits of the proposed tax overhaul are unlikely to materialize under such a high consumption tax rate. Policymakers seeking to limit property taxes have better-targeted ways to achieve these aims.

The Tax Foundation's more thorough study found that the consumption tax base specified by the EPIC plan is only 45 percent as large as proponents anticipated.

| Tax Base (Millions) | EPIC Study | Tax Foundation |

| Nebraskan's Personal Consumption | $108,492 | $46,551 |

| Nonresident Personal Consumption | $0 | $1,868 |

| Government Consumption | $10,637 | $0 |

| Government Salaries & Wages | $9,342 | $0 |

| New Home Sales | $6,479 | $3,867 |

| Administrative Fee | -$337 | -$158 |

| Total Tax Base | $134,612 | $67,805 |

| Statis Revenue Replacement Rate (2026) | 8.67% | 21.60% |

| Dynamic Revenue Replacement Rate (2026) | 7.23% | n.a. |